2018年USCPA考试Q4考季马上结束了,泽稷教育小编为帮助广大学员全力冲刺备考接下来的考试,特别为同学们总结了《财务会计与报告FAR》的常考知识点:现金流——cash flow。

Module 2:Statement of Cash Flows(I)

1.Presentation requirements

●FS must includes Statements of CFs

●Provides information of cash receipts from and cash disbursements to by each activities

●Information of material noncash events also presents

●US.GAAP does not require disclosing cash flow per share

●IFRS does not prohibit presentation of cash flow per share

2.Cash and cash equivalents

●Cash:actual cash(i.e.,currency,demand deposits)

●Cash equivalents:short-term liquid investment

●Readily convertible into certain amounts of cash

●So near maturity that the risk of changes in the value because of interest rate changes is insignificant.

e.g.treasury bills;

<90 days original maturity period high liquid investments

Note:Bank overdraft is not cash under US.GAAP,but can be included in cash under IFRS.

要点一:

现金等价物:

-高流动性,可快速变现(充分流通的市场)短期票据/投资

-原始到期日(变现期限)小于90天

-现金价值金额固定或几乎无价值变动风险

-公司对现金等价物有明确会计政策,并在FS中充分披露

3.Cash flow statement(CFs)

Statement of CF reconcile cash&cash equivalents from beginning balance to ending balance

Composed by:

●Operating cash flows(CFO),from transactions reported on the I/S,and current assets and current liabilities.

●Investing cash flows(CFI),from noncurrent assets.

●Financing cash flows(CFF),from debt(non-current liabilities)and equity.

●Cash and cash equivalent beginning balance+CFO+CFI+CFF(net increase/decrease in cash)

=cash and cash equivalent ending balance

●Methods of Edit CFO

–The direct method(encourage)

–The indirect method

Direct/Indirect method only different on CFO

The CFI&CFF are the same.

4.Direct method

Convert each major item on I/S into cashable ones

●Present major classes of CFO

e.g.cash received from customer,cash paid to suppliers and employees

●Noncash items do not appear

e.g.Depreciation,amortization,depletion,equity method income

●Reconciliation of NI to CFO is required as a separate schedule under U.S.GAAP.

要点二:

Major CFO items calculation

公式:各项损益表经营性项目+/-资产负债表项目变化

1)Cash received from customers

=Revenue…………………………Accrual basis

–Receivable increase

+Receivable decrease

+Increase in unearned revenue

–Decrease in unearned revenue

2)Cash paid to suppliers

=Cost of goods sold…………………Accrual basis

+Inventory increase

-Inventory decrease

-AP increase

+AP decrease

3)Cash paid to employees

=Salaries and wages payable……………Accrual basis

-Wages payable increase

+Wages payable decrease

4)Other operating cash payments

=Other operating expenses………………Accrual basis

+Prepaid expense increase

-Prepaid expense decrease

+Accrued liabilities decrease

-Accrued liabilities increase

Module 2:Statement of Cash Flows(II)

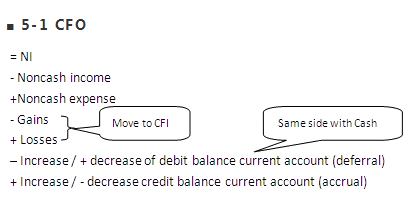

5.Indirect method

●Debit balance accounts:

AR,Inventory,Prepaid expense,DTA

●Credit balance accounts:

AP,accrued expense,unearned revenue,DTL

●Non cash expense:

Depreciation,amortization,depletion,allowance/provision,goodwill impairment

●Non cash income:

Income by payment of property,service,securities,COD.

●None operating Gain/Loss

Remove and analyze actual net receipt from CFO to CFI

e.g.Gain/loss from sales of PP&E or land,should be removed from NI,instead report in CFI the full proceeds received from sales of PP&E or land.

Undistributed earned on entity investment,removed from NI.Report actual dividends received in CFO.

要点三:经营净现金流间接法计算

●净利润为起点,调整非现金收支和非经营项目

●非现金收入主要考虑非现金对价的收入,如对价为实物资产,股权,证券,COD等

●非现金支出主要考虑:1)折旧摊销等为满足匹配原则的长期成本回收项目2)为满足谨慎性原则的准备和减值项目

●将长期资产购置处置,股权投资购置,收益及处置,和融资内容调整至CFI,CFF,并将其中的非现金部分单独补充说明

●Timing difference经营性净收入口径由Accrual basis调整为Cash basis

调整资产和负债中应计(收现延迟),和预提(付现延迟)项目,及预收(收现提前)和预付(付现提前)项目,以流动性项目为主

●部分非现金及资产负债项目的分析

如存在坏账核销,由于坏账核销不影响当期净损益但影响AR期末数据,应在NI的非现金AR调整中剔除

债券溢价或折价发行时,cash paid for interest应考虑损益表项目利息费用+/-债券溢价/折价的摊销

e.g.Amortization of bond discount has to be added back to net income to get the CFO.(interest paid is in CFO)

利息资本化和非资本化的内容分别计算,资本化部分CFI,非资本化部分CFO

当期折旧费用可以通过B/S累计折旧/净值的变化,剔除PP&E购置或处置带来的折旧/净值变化因素得到。

■5-2 CFI

Purchase or sale of non-current assets

e.g.PP&E,Finance assets(available-for-sale,held-to-maturity),acquiring other entity under acquisition method,loan principle outflow/inflow

■5-3 CFF

Transactions regarding non-current liabilities and equity

e.g.Issue stock,bonds,notes,dividends,repurchase,repay principle,treasury stock transaction(note:receipt dividends&interest,paying interest are CFO;Paying dividend are CFF)

■5-4 Noncash Invest and Finance activities

要点四:非现金投资和融资行为单独披露,分项说明

Supplemental schedule on noncash investing or financing as they may impact significantly future CF

e.g.Purchase PP&E or entity by issuing stock,notes,or by COD.

●Conversion bond to equity,preferred share to common share as financing activity(从负债转为权益项目)

●Capital lease obligation for acquiring assets

●Noncash assets exchange

要点五:所得税和利息单独披露要求

●Allocation specifically related with investing or financing taxes to CFI/CFF is allowable in IFRS,tax paid separately present in CF is required.

●US GAAP requires income taxes paid and interests paid(net of amounts capitalized)be separately presented in CF statement as CFO items,direct method,or disclosed in supplemental disclosure,indirect method

●Cash flow per share should not be reported on the statement of CF under U.S.GAAP,because it may be misleading and may be incorrectly used as a measure of profitability.

泽稷教育小编预祝每位AICPA学员都将在FAR考试中取得好成绩!